child tax credit september 2021

What are Advance Child Tax Credit payments. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money.

October Child Tax Credits Issued Irs Gives Update On Payment Delays

Babies born in 2022 and beyond.

. That means a baby. Verifying Your Identity to Manage your Payments These updated FAQs were released to the public in Fact Sheet 2022-07 PDF February 1 2022. As part of the Build Back Better bill the House voted in November 2021 to make.

Frequently asked questions about 2021 Child Tax Credit and Advance Child Tax Credit Payments. The 2021 advance monthly child tax credit payments started automatically in July. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax return during the 2022 tax filing season.

How Much is the Child and Dependent Care Tax Credit Worth. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of. It can be tricky to calculate exactly how much the tax credit will be worth when it comes time to file your taxesHowever the basic starting point is that you get up to 3000 for one dependent and up to 6000 for having multiple dependents in dependent care.

Advance payments July through December 2021. The expansion of the Child Tax Credit that was part of the American Rescue Plan expired at the end of December 2021. Unless the expanded child tax credit is extended parents of 2022 babies will not be receiving monthly checks or the full 2021 amount of 3600.

The 2021 child tax credit provides parents with up to 3600 per child for kids under 6 and 3000 for all other children under 18 with half of the money being doled out as monthly payments that started this week. Unlike in previous years the new credit also allows families with extremely low or no income to qualify for the entire benefit.

Latest Child Tax Credit Payment Delayed For Some Parents Cbs News

Resources Charlotte Center For Legal Advocacy

Expiration Of Child Tax Credits Hits Home Pbs Newshour

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

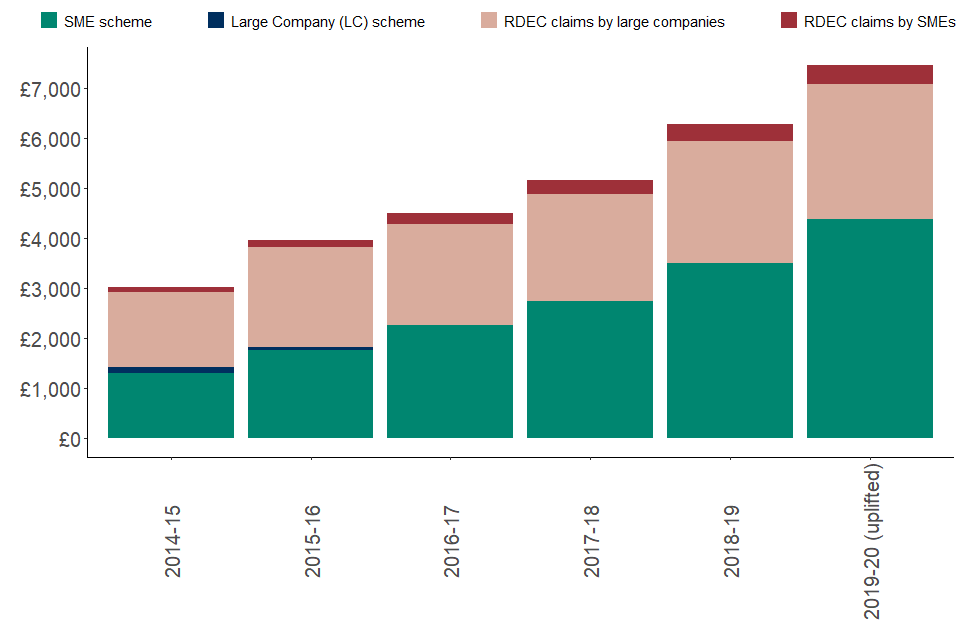

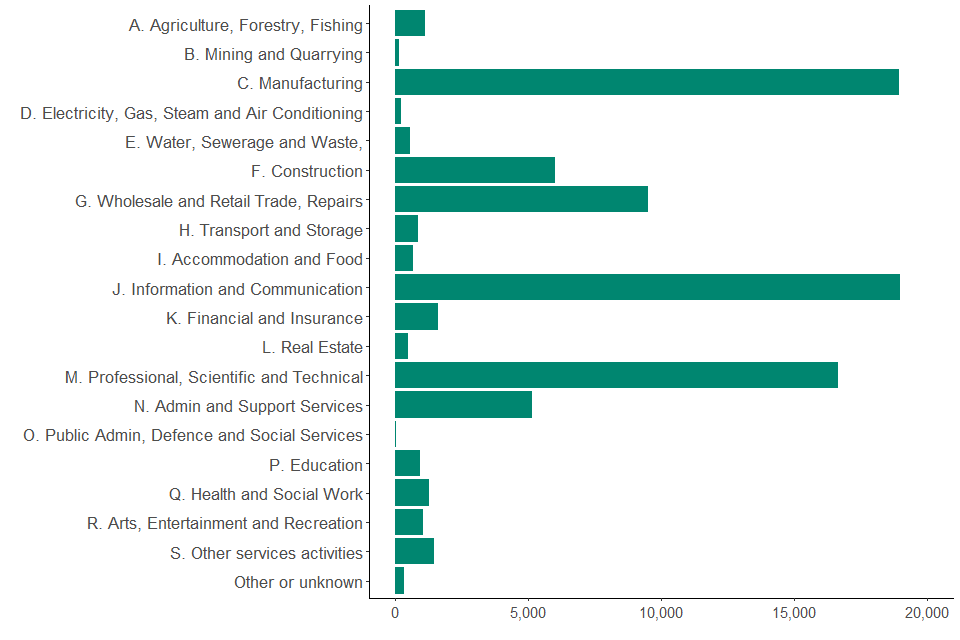

Research And Development Tax Credits Statistics September 2021 Gov Uk

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Schedule How Many More Payments Are To Come Marca

Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

What Divorced Or Separated Parents Need To Know About Child Tax Credits Elmhurst Family Law Attorney

Macroeconomic Projections December 2021 Banque De France

Latest On Tesla Ev Tax Credit February 2022

Research And Development Tax Credits Statistics September 2021 Gov Uk

Child Tax Credit Schedule 8812 H R Block

Updated Irs Releases Guidance On Arpa Paid Leave Tax Credits Sequoia

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities